Planning a small-batch sweater run with two colors across five sizes? This FAQ lays out realistic MOQs, timelines, and what changes when you choose stock-service yarn versus yarn-dyed/custom colors. The answers assume basic stitches, two colors × five sizes, and low-MOQ production, with notes where WHOLEGARMENT complexity adds time.

Key takeaways

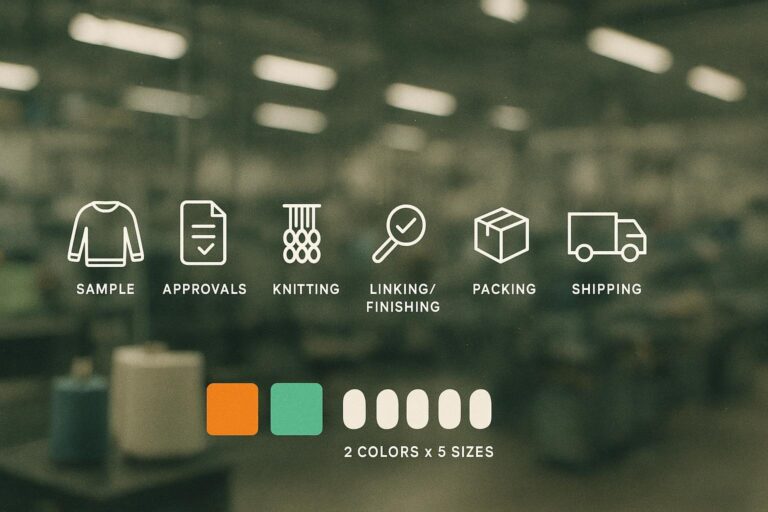

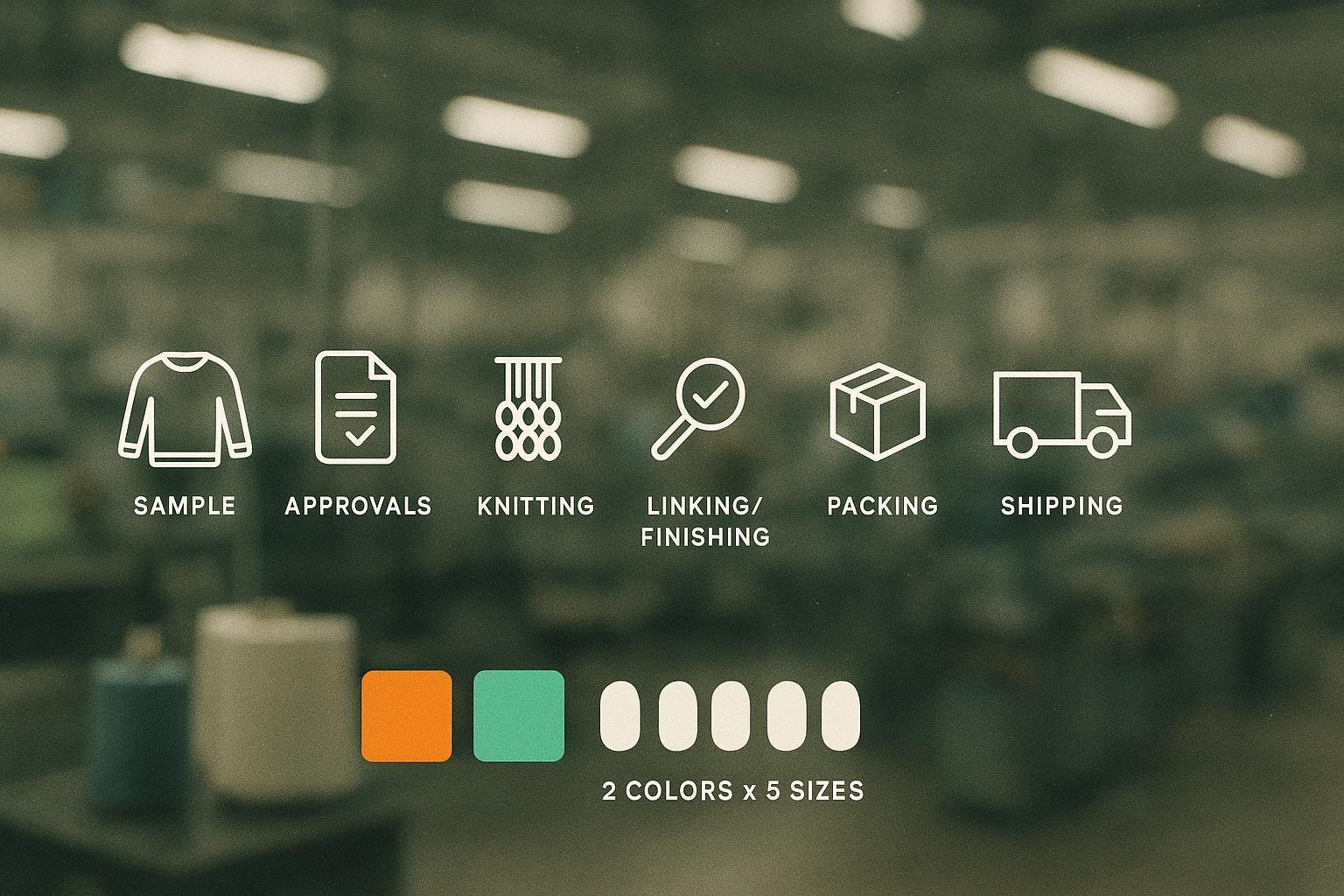

For a low MOQ knitwear manufacturer, samples are typically 3–5 business days (fast-track) or 7–10 business days standard; bulk is ~21–35 days after approvals for stock-service yarn. WHOLEGARMENT complexity can add ~1 week.

MOQ policy is commonly per style per color; a typical band is 50–300 units per color. In a 2-color × 5-size plan, confirm whether there’s a per-color minimum and any per-size floor.

Stock-service yarn is the fastest route; yarn-dyed/custom shades add lab dips and dye-lot scheduling, often pushing total timelines into multi‑week territory and increasing per-color MOQ pressure.

Staggered deliveries (e.g., 70/30 or 50/50) help hit retail windows; you can switch a tail tranche to air while the balance sails by ocean.

Around China’s peak periods (Chinese New Year, Golden Week, Double 11), build production and freight buffers into your calendar.

At-a-glance SLAs (assumes two colors × five sizes, basic structures)

Stage | Typical range | Notes & assumptions | Evidence |

|---|---|---|---|

Samples | 3–5 business days (fast) / 7–10 (standard) | Tech pack/photos ready; using stock-service yarn/colors where possible | Vendor example shows rapid prototyping in 3–5 days; standard band widely practiced: see the KnitSeek policy in its FAQ on timelines and MOQs (2025–2026). KnitSeek FAQ |

Bulk (stock-service) | 21–35 days after approvals | Basic stitches; low-MOQ; two colors × five sizes | KnitSeek publishes 15–25 days standard and a 12‑day expedited option; planning at 21–35 days is realistic for small brands. Vendor SLA example: KnitSeek FAQ |

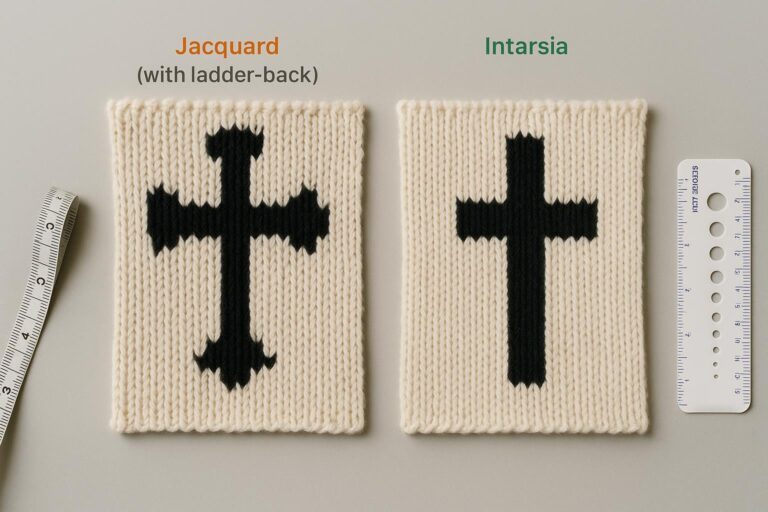

WHOLEGARMENT complexity | + ~1 week when warranted | New 3D programming, complex patterns, or heavy intarsia | Industry coverage notes workflow acceleration but not a fixed adder; “+1 week” is typical practice for new programs. |

What’s a realistic MOQ for two colors × five sizes?

Quick answer: Many factories set MOQ per style per color. Expect a working band of 50–300 units per color depending on yarn route and factory policy. For a simple 2‑color × 5‑size run, a common setup is 10–20 units per size per color.

Context and example: If MOQ is 100 units per color, five sizes at 20 units each yields 100 units in Color A and 100 units in Color B—200 total. Some vendors accept lower per‑color MOQs (e.g., 50–80) with a price premium, especially when using stock-service yarn where the factory doesn’t need to commit to a large dye lot. Others require higher per‑color minimums when yarn-dyed/custom colors are involved because dye lots push up economic MOQs.

What to confirm with your factory: whether MOQ is per color or per style aggregated across colors; if there is a minimum per size per color; whether size ratios are flexible; and if a “price break” exists at higher quantities.

What are typical low MOQ knitwear manufacturer lead times for samples vs bulk?

Quick answer: Fast-track samples commonly ship in 3–5 business days; standard samples in 7–10 business days. For stock-service yarn, bulk production is typically 21–35 days after approvals at low MOQ. Add ~1 week when a brand-new WHOLEGARMENT program is involved.

Assumptions and timeline sketch: Day 0 you submit a tech pack or annotated photos. By Day 3–5 a fast-track sample can be ready. After you approve PP/TOP, production clocks begin. For a basic jersey or rib, knitting, linking/finishing, washing, and QC slot into a 3–5 week window depending on line availability and the two-color setup. New WHOLEGARMENT programs add programming, first-article tuning, and sometimes gauge-specific checks; when those are new to the factory on your style, plan an extra week.

For external benchmarks, one vendor publishes rapid prototyping at 3–5 days and standard bulk at 15–25 days; using 21–35 days in planning gives you breathing room and aligns with small-brand variability. See the vendor’s FAQ on timelines and MOQs: KnitSeek FAQ.

How do stock-service yarn and yarn-dyed/custom colors change lead times and MOQs?

Quick answer: Stock-service yarn shortens both sampling and bulk because shade and inventory already exist. Yarn-dyed/custom colors introduce lab dips and dye-lot scheduling, which extend timelines and raise per-color MOQ pressure.

What changes in practice: With stock-service, you skip lab dips and can sample in 3–5 days and move to bulk inside 21–35 days after approvals, assuming capacity. With yarn-dyed, add color development (lab dips) and commit to dyeing minimums before knitting. In knit apparel sourcing, minimum dye lots can approach a few hundred kilograms per color, which is why per-color MOQs rise on custom shades; for context, an industry profile cites a roughly two-hundred‑kilogram dye-lot example for knit products. See the sourcing context in Apparel Resources’ coverage of dye-lot economics: minimum dye lot pressure in knit sourcing (2024). Apparel Resources – dye lot context

What to confirm with your factory: how many lab dip rounds are typical; whether a nearest-stock shade can be accepted to stay on the faster path; minimum dye lot by fiber; and any surcharge for sub‑lot orders.

Can I stagger deliveries (70/30, 50/50) or switch part of the order to air?

Quick answer: Yes. Splitting a PO into tranches (for example, 70% first, 30% later) can help you hit the shelf date, reduce sell‑through risk, and smooth cash flow. Many brands ocean-ship the first tranche and, if needed, switch a portion of the tail to air.

How it works operationally: The factory schedules knitting and finishing for the first tranche, you approve TOP, then they release packing and book freight for tranche one while continuing the remainder. Use a rolling pre‑shipment inspection near 80% of each tranche’s completion under an AQL plan; that keeps quality gates aligned without holding both tranches hostage to a single inspection. For AQL/PSI practice, see QIMA’s explanation of AQL sampling and pre‑shipment inspections. QIMA AQL and PSI

Transit time snapshots to plan the switch: China → US West Coast is roughly 29–33 days by ocean versus 5–10 days door‑to‑door by air, per recent logistics updates. See Flexport’s China–US lane timing context (2025) for a planning reference. Flexport update

When to consider air: if the shelf date is inside 2–3 weeks and your tranche is small enough to fly economically. Think of ocean for the base and air as the agile tail.

How do China’s 2026 holidays affect planning—and what buffers should I add?

Quick answer: Expect capacity and logistics crunches around Chinese New Year (Feb 15–23, 2026) and National Day Golden Week (Oct 1–7, 2026). Double 11 (Nov 11) isn’t a public holiday but drives peak logistics. Submit POs earlier and add buffer weeks to both production and freight.

Holiday anchors and buffers: Public calendars list Chinese New Year Feb 15–23 and National Day Oct 1–7 in 2026. See TravelChinaGuide’s 2026 China public holiday calendar for official dates. China public holiday dates (2026) In practice, add buffers rather than bullets: for CNY, place POs 6–10 weeks earlier than usual and add 2–4 production weeks if your schedule spans late January to late February; for Golden Week, submit POs 4–8 weeks earlier and add 1–3 weeks buffer; for Double 11, build roughly two weeks of logistics buffer for parcel and line‑haul congestion.

Note on capacity buffers: Some factories hold internal capacity buffers around these peaks to protect existing orders. If you work with a low MOQ knitwear manufacturer that states holiday buffers, clarify the dates and how they apply to your PO.

Practical example: building a low‑MOQ calendar from sample to first receipt

Disclosure: Xindi Knitwear (Knitwear.io) is our product.

Assume a May 1 shelf date for a simple sweater, two colors × five sizes, stock-service yarn.

Sampling: Request on March 3; sample ships March 7 (fast-track). Approve March 9.

Bulk window: March 10–April 10 (four weeks). Because this is a straightforward structure, the 21–35 day planning band applies.

Freight: Book ocean LCL departing mid‑April; arrival US West Coast ~early to mid‑May. If risk rises (e.g., booking crunch), shift 30% of Color B to air in late April to guarantee the shelf date.

Holiday buffers: For SKUs landing near Golden Week, the factory keeps internal capacity buffers the week before and after Oct 1–7; confirm whether your production block is protected inside those buffers.

The same logic holds for WHOLEGARMENT with a new program: add ~1 week before the bulk window for programming and first‑article tuning.

What should I confirm with the factory before locking POs?

MOQ rules: per style per color vs aggregated; any per‑size floor and size ratio flexibility.

Yarn route: stock-service shade availability vs yarn‑dyed/custom; minimum dye lot by fiber.

SLA gates: sample SLA (fast vs standard), bulk SLA after approvals, WHOLEGARMENT adder if applicable.

Quality control: inspection level (AQL), PSI timing, lab tests (pilling, shrinkage, colorfastness) timing relative to ship date.

Logistics plan: tranche setup (70/30 or 50/50), ocean vs air decision points, and booking cutoffs around holiday peaks.

A quick recap and next steps If you remember one thing, it’s this: define your yarn route early and lock approvals fast, then guard your calendar around holiday peaks with realistic buffers. Use staggered deliveries to protect the shelf date, and treat air as the contingency tail. For deeper planning, keep a rolling 12‑month production calendar that highlights CNY, Golden Week, and Double 11.