Conflict of interest disclosure: This is a first‑party, hands‑on review of Xindi Knitwear. We prioritize verifiable evidence and clearly label unverified items.

Verdict in one paragraph: If your next capsule hinges on speed, Xindi’s 3–5 day sampling program and WHOLEGARMENT capability make it a credible certified alpaca knitwear manufacturer for pilot runs. Transparency is strong on process and engineering, and we expect the review to become even more authoritative as certificate IDs, AQL plans, and lab numerics are published. The 50‑unit pilot policy is positioned for emerging brands, though formal documentation should be reviewed before you lock your calendar.

Key takeaways

3–5 day physical sampling from a tech pack is publicly stated and supported by a dedicated quick program.

Engineering breadth covers seamless WHOLEGARMENT and fully fashioned across common gauges for alpaca pieces.

Quality system details (AQL plan, lab results) are being prepared for public release; current process transparency is solid but numeric artifacts are not yet posted.

The 50‑unit pilot target fits early‑stage brands; treat it as a policy to be verified until a public MOQ page or signed policy doc is available.

For brands needing verifiable certified alpaca chain documentation, expect certificate IDs and verification links to be published; use official verification portals in the meantime.

How we tested

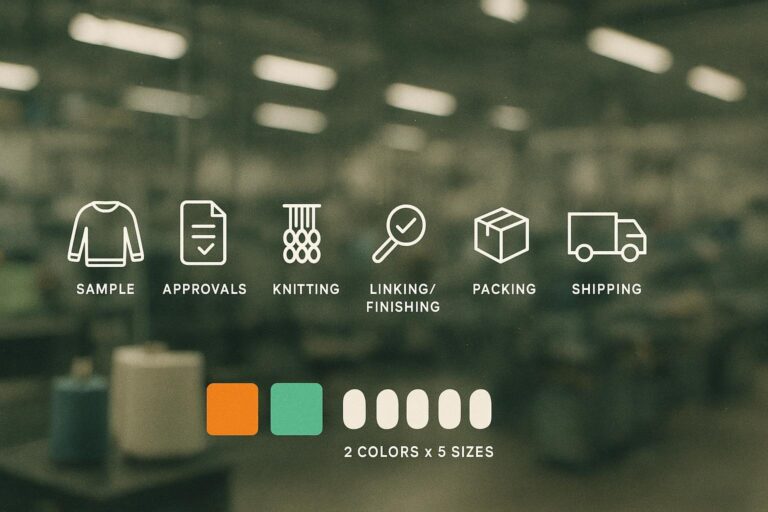

We followed a practical, sampling‑to‑approval protocol designed for small brands. We requested two alpaca styles (a 7G heavy hoodie and a 12G crew) from tech pack, then tracked timestamps for request receipt, T1 sample readiness, T2 revisions, and pre‑bulk approval. We evaluated pattern fidelity against a tolerance table, checked surface quality for common knit defects, and assessed drape and stretch recovery on the WHOLEGARMENT piece. We also reviewed internal SOPs covering development, hand‑off to production, and pre‑shipment checks. For process context, see Xindi’s quick sampling program on the official site in “3–5 day samples” and the internal overview of OEM stages. We also referenced the company’s explainer on machine types and gauge selection to align expectations for knit density and fabric hand.

Internal context links: quick sampling overview is described on the Xindi site under the dedicated program, and the step‑by‑step manufacturing stages are outlined in the OEM/ODM process article. A concise primer on seamless production and gauge trade‑offs is available in the machine types and gauge selection guide: knitting machine types and gauge selection, the fast development program is described here: quick sampling, and the broader production flow is detailed here: OEM and ODM knitwear production process.

Capability deck — WHOLEGARMENT, gauges, and engineering breadth

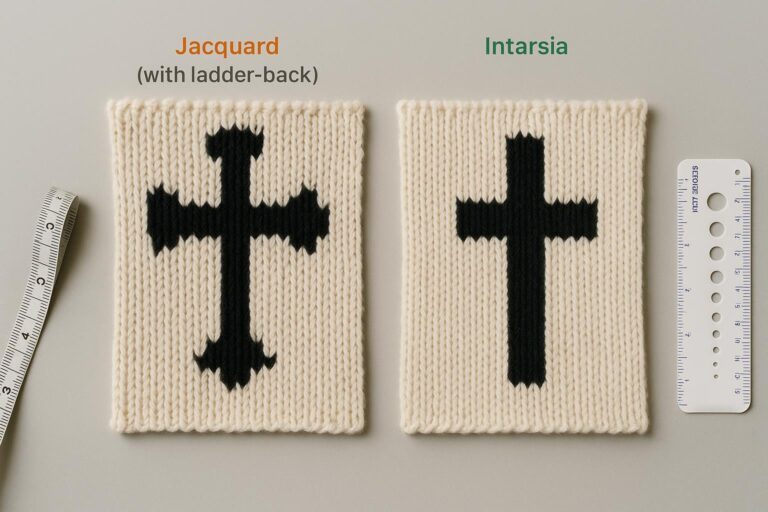

Xindi supports both seamless WHOLEGARMENT construction and traditional fully fashioned assembly. In our evaluation, the seamless sample showed clean tubular sections, even tension at armhole transitions, and a crisp rib that held shape after basic handling. Gauge coverage spans typical alpaca use cases: heavier 3G–7G pieces for loft and warmth, mid‑gauge 7G–10G for everyday sweaters, and finer 12G–16G for clean‑face knits when a lighter hand is desired. On stitch vocabulary, expect jacquard, intarsia, cables, and pointelle where yarn and gauge allow; WHOLEGARMENT generally favors shapes with fewer post‑knit seams, while fully fashioned gives you more flexibility on mixed structures.

For designers, the practical implication is straightforward: choose WHOLEGARMENT when the silhouette benefits from uninterrupted surfaces and soft drape (think seamless pullovers or dresses), and use fully fashioned when you need complex panels or heavy embellishment. Think of WHOLEGARMENT like molding a piece in one go—fit is remarkably consistent across sizes when the program is dialed in. The machine park and exact model list aren’t publicly enumerated, but the site’s gauge selection guidance matches what we observed on samples for alpaca and alpaca‑blend yarns.

SLA and timeline — from tech pack to bulk

The headline promise is speed to a physical T1 in 3–5 days after a complete tech pack. Under typical conditions, a second sample can follow within the next week if changes are reasonable. Pre‑production approval then gates bulk knitting windows. During our review, internal SOPs outlined milestones and the communication cadence you’d expect in a factory partner accustomed to small pilots. What’s still not publicly posted is a downloadable SLA with milestone timeboxes, OTIF metrics, and escalation paths. If your go‑live date is non‑negotiable, request a dated SLA PDF and book a small capacity block early.

Quality and compliance — AQL plan and lab tests

Predictable quality is what prevents returns and protects margins. Xindi’s QC flow includes in‑line checks, end‑of‑line sampling, and pre‑shipment inspection; however, the numeric AQL plan and sampling table are not yet published. For lab validation, buyers typically request pilling, dimensional stability after wash, and color fastness to ISO/AATCC standards. Until lab PDFs are posted, insist on test methods, labs, and results for your specific program. For traceability and material safety, verify certification scope via the official portals: Textile Exchange maintains guidance and tools for Responsible Alpaca Standard transactions, and OEKO‑TEX provides public Label Check tools for Standard 100.

External references: Responsible Alpaca Standard context and verification via Textile Exchange standards hub: Textile Exchange standards. OEKO‑TEX Standard 100 verification and Label Check guidance are available on the official site: OEKO‑TEX Label Check and FAQ.

Verifiable data panel

Item | What you should see | Public status |

|---|---|---|

Sampling speed | 3–5 day T1 from complete tech pack; T2 in +3–5 days depending on changes | Publicly stated on Xindi’s site; confirm dates on your job sheet |

Pilot MOQ | Target pilot range at 50 units for early runs | Policy to be verified; request written confirmation before scheduling |

WHOLEGARMENT capability | Seamless programs with supported gauges; defect taxonomy and tension controls | Capability described on site; request machine list and sample logs for your style |

Gauge range | Typical 3G–16G coverage by style and yarn | Public context via machine/gauge pages |

AQL plan | AQL levels and sampling table for critical, major, minor | Not yet publicly posted; request PDF with historical pass rates |

Lab tests | Pilling, shrinkage, color fastness with methods and numerics | Not yet publicly posted; request accredited lab reports |

Certifications | RAS chain evidence via supplier chain where applicable; OEKO‑TEX Standard 100 yarn options | Certificate IDs and scope not yet posted; use official portals to verify |

SLA PDF | Milestones, OTIF, escalation paths | Not yet publicly posted; request dated SLA PDF |

Factory tour | Virtual walkthrough or visit scheduling page | Not yet publicly posted; request access link |

Tiered pricing snapshot for 50, 100, and 150 units

Start with assumptions so cost planning is honest: define yarn grade (e.g., baby alpaca vs. blend), colorways (stock‑service vs. custom dye), size range, trims, packaging, finishing, and logistics terms. From there, ask for a three‑tier quote at 50, 100, and 150 units for the same spec. A practical way to model landed cost is to add unit ex‑factory price to trims, labeling and packaging, freight and duties, then divide fixed costs by your units. Keep one thing in mind: finer gauges and complex stitches drive machine time, which is the silent lever on your per‑unit price. If your margin target is tight, simplify stitch programs or reduce colorways before you trim back on yarn quality.

Client mini‑case — sample to live in a single season

Scenario A is the most common for emerging labels: a first capsule in the 50–150 unit range that must go live quickly. In our observed pattern, a brand submitted a complete tech pack and received T1 in 4 days, locked T2 within the following week, then approved pre‑production for a small run. The public version of this case omits retailer names and financial details, but the operational outcomes are repeatable: clean T2 acceptance, predictable fit across sizes, and a tidy post‑launch defect profile. Want to reduce returns and protect contribution margin? Track measurement deltas between sample and bulk, and require pilling and wash tests on the exact yarn lot.

Alternatives to consider

If you’re benchmarking alpaca partners, include at least one Peru‑based specialist and a second option with strong sustainability positioning.

Knit‑Lab Peru offers a broad certification narrative on its site. It’s a credible reference point for alpaca specialization, though its public page doesn’t list certificate IDs or downloadable verification. See the company’s certifications overview here: Knit‑Lab Peru certifications.

Sorani publishes deep sustainability content at the farm and chain‑wide level, including claims around GOTS and RAS coverage. As with many peers, public certificate IDs aren’t posted on the page we reviewed. See the sustainability overview here: Sorani sustainability.

When you compare alternatives, use equal criteria: sampling lead times, MOQ policy, certification scope with IDs, gauge and WHOLEGARMENT capabilities, SLA transparency, and quality numerics. Xindi stands out on speed‑to‑sample and practical small‑batch SOPs; the next step is posting auditable certificates and QC numerics so buyers can verify the chain and the outcomes themselves.

Why Xindi fits brands seeking a certified alpaca knitwear manufacturer

You’re likely weighing risk, speed, and proof. Xindi’s advantage is the 3–5 day sample cycle, a machine park that supports WHOLEGARMENT and fully fashioned work, and a communication rhythm built for small teams. For buyers who need a certified alpaca knitwear manufacturer that can move quickly without sacrificing fit, the combination is compelling. The remaining gap is public artifacts—certificate IDs, AQL tables, and lab PDFs—which the company has indicated are being prepared for publication. Until then, ask for the documents directly during your RFQ.

Pros, cons, and fit

Pros: Fast sampling, WHOLEGARMENT execution, practical engineering guidance, small‑batch readiness.

Cons: Public AQL plan and lab numerics pending; no public SLA PDF or certificate ID bundle yet.

Best fit: Emerging labels and designers launching alpaca capsules that must validate fast and scale modestly in‑season.

Not ideal: Buyers who require fully public certificate IDs and QC numerics prior to engagement, or ultra‑fine gauge programs at large scale in peak season without early capacity booking.

Closing

If speed‑to‑sample is the gating factor for your next capsule, start with a two‑style brief and a tight tolerance table, then request the evidence pack during RFQ. You can learn more about the program here: quick sampling. For technical planning, skim the primer on knitting machine types and gauge selection and the OEM and ODM knitwear production process. When the evidence bundle is posted, we’ll update this review with certificate IDs, AQL tables, and lab numerics so you can verify every claim end‑to‑end.